43 how to calculate a bond's coupon rate

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips The rate you'll pay on bond interest is the same rate you pay on your ordinary income, such as wages or income from self-employment. There are seven tax brackets, ranging from 10% to 37%. So if... Calculating U.S. Treasury Pricing - CME Group The two constitutes 2/8, or ¼, of a 1/32. A plus constitutes ½ of 1/32, and six constitutes 6/8, or ¾, of 1/32. So our bid-side quote converted from 1/32 to a decimal would be: 99-032 (1/32s) = 99.1015625, or 99.1015625 percent of par. The offer-side price would convert to 99-03+ = 99.109375.

U.S. Treasury Bond Overview - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... U.S. Treasury Bond Yield Curve Analytics ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View ...

How to calculate a bond's coupon rate

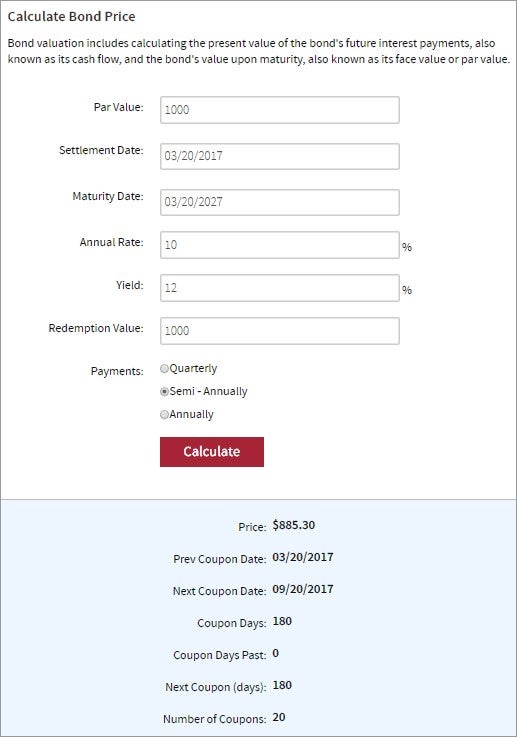

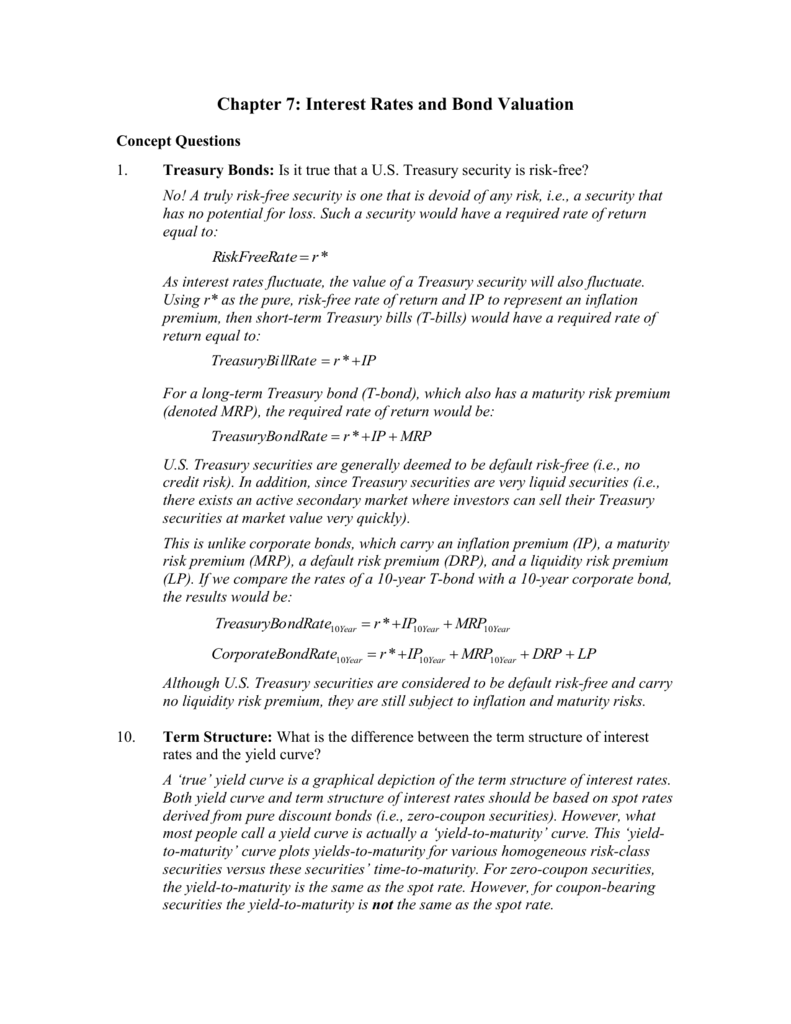

Bond Pricing | Valuation | Formula | How to calculate with example | eFM Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8 The following is the summary of bond pricing: Treasury Return Calculator, With Coupon Reinvestment The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds are sold at the 7 year mark asking for the 10 year yield. Calculate the present value of a bond that pays a coupon rate of 4% ... Calculate the present value of a bond that pays a coupon rate of 4% per year for 15 years, and matures in 15 years at its face value of $1000, using each of the following current market interest rates...

How to calculate a bond's coupon rate. What Is Discount Rate and Why Does It Matter? - SmartAsset Since October 31, 2019, the primary rate has been 2.25%, and the secondary rate, which must be 50 basis points higher, has been 2.75%. The seasonal rate is a floating rate based on market conditions and is the average of the federal funds rate and the rate of three-month certificates of deposit (CDs). Why The Discount Rate is Important How Can I Calculate the Carrying Value of a Bond? To calculate the carrying value, one must first determine the bond's par value, its interest rate, and its time to maturity. Calculating Carrying Value The first step in calculating carrying value... Principal of a Bond | Definition | Finance Strategists The coupon rate is the percentage of the principal paid back to the investor as interest. Whatever the principal is, the coupon rate is a percentage of that value. The bond maturity date is the date on which the principal must be paid back to the bondholder. Fitted Yield on a 1 Year Zero Coupon Bond - St. Louis Fed Graph and download economic data for Fitted Yield on a 1 Year Zero Coupon Bond (THREEFY1) from 1990-01-02 to 2022-05-06 about 1 year +, bonds, yield, interest rate, interest, rate, and USA.

I Bonds Are More Appealing Than Ever. Here's Why - CNET The US Treasury applies a formula to this data and the fixed rate to calculate the total interest rate on I bonds. I bond interest rates are updated on the first business days of May and November ... How Do I Determine the Fair Value of a Bond? (with picture) To illustrate, is helps to consider a bond that has $1,000 USD par value, pays $100 coupon per year, with a 9% yield or discount rate, and will mature in three years. P = 100/ (1+0.09) + 100/ (1+0.09)^2 + 100/ (1+0.09)^3 + 1000/ (1+0.09)^3, which is equal to the fair value of $1025.31 USD. How to calculate interest expense - AccountingTools To calculate interest expense, follow these steps: Determine the amount of principal outstanding on the loan during the measurement period. Determine the annualized interest rate, which is listed in the loan documents. Determine the time period over which the interest expense is being calculated. Use the interest formula to arrive at the ... Individual - Redemption Tables - TreasuryDirect Current Values. Select the link below for a PDF of values in the current earnings period. An updated version is available every six months. June 2022 - November 2022 PDF Format, File Size - 1,017 KB, File Uploaded 05/03/22. Get help downloading.

Singapore Savings Bond 2022 - Interest Rate, Yield & How SSB Works 3 January 2022. 1 January 2032. 1.78%. Source: MAS. The average 10-year rate of returns for SSBs seems to be experiencing a steady increase, usually ranging from 1% to 3%, with the highest rates between 2% to 3% offered in 2019. Treasury Bonds | CBK This calculator allows you to determine the price of a bond that is re-opened or sold on the secondary market. Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table above. Effective Interest Method Definition The APR accounts for compound interest plus other costs associated with a loan. Effective Interest Method and Accretion Assume an investor buys bonds with a $500,000 par value and a coupon rate of... How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Bond Yield | Definition | Finance Strategists A bond purchased at its face value of $1000 with a coupon rate of 5% returns $50 annually, so its yield is 5%. If the bondholder later sells the bond to another investor at a premium for $1100, the bond will still return $50 annually, but its yield will be lower. $50 is 4.5% of $1100, so the yield to the new investor is only 4.5%.

I Bonds Rates Will Increase To 9.62% (May 2022 Update) Ninja Update 4/29/22: I Bonds purchased now will count as May purchases and immediately get the 9.62% rate. Purchases no longer gets the 7.12% + 9.62%. Instead you'll get the 9.62% rate for 6 months and then an unknown rate for the following 6 months. This is still a great opportunity to lock in a high return with zero risks.

Calculate the yield to maturity for the bond in the | Chegg.com Calculate the yield to maturity for the bond in the table. Round to 3 decimal places. Coupon Rate Maturity Date Last Trade Price Last Trade Date 4.50% 4/25/2035 $90.25 5/12/2022 Question: Calculate the yield to maturity for the bond in the table. Round to 3 decimal places.

How to Calculate Interest Rate on a Treasury Bill - Pocketsense Dividing that difference by the purchase price then conveys the rate. Using the example above, $71 is the difference between the buy price and face value. Since the bond is purchased at $929 (quite low), dividing the profit by the purchase price gives a quotient representing the discount rate.

Calculate the fair present values of the following bonds Calculate the fair present values of the following bonds, all of which pay interest semiannually, have a face value of $1,000, have 10 years remaining to maturity, and have a required rate of return of 15.5 percent. a. The bond has a 7.2 percent coupon rate. (Do not round intermediate calculations. Round your answer to 2 decimal places.

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and therefore owes a debt to the purchaser of the bond.

91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 0.90. 0.86. 0.02. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... The combination of the fixed rate and inflation-adjusted rate creates the I Bonds' composite interest rate, which was 7.12% but now rises to 9.62%, the highest in history for I Bonds. An I Bond bought today will earn 9.62% (annualized) for six months and then get a new composite rate every six months for its 30-year term.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value

Calculate the present value of a bond that pays a coupon rate of 4% ... Calculate the present value of a bond that pays a coupon rate of 4% per year for 15 years, and matures in 15 years at its face value of $1000, using each of the following current market interest rates...

Treasury Return Calculator, With Coupon Reinvestment The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds are sold at the 7 year mark asking for the 10 year yield.

Bond Pricing | Valuation | Formula | How to calculate with example | eFM Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8 The following is the summary of bond pricing:

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "43 how to calculate a bond's coupon rate"