42 ytm zero coupon bond

Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. How to calculate yield to maturity in Excel (Free Excel Template) You will want a higher price for your bond so that yield to maturity from your bond will be 4.5%. Let's calculate now your bond price with the same Excel PV function. =-PV (4.50%/4, 4*10, 1500, 100,000) = $112,025.59. So, you will be able to sell your bond at $112,025.59 with a premium of amount $12,025.59.

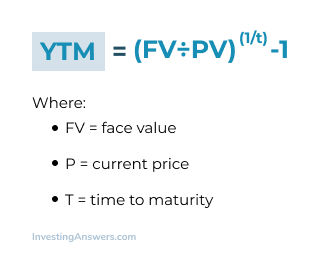

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Ytm zero coupon bond

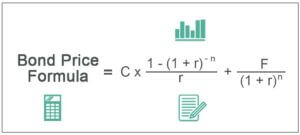

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) YTM for a zero coupon bond? | Forum | Bionic Turtle YTM for a zero coupon bond? Thread starter sudeepdoon; Start date Nov 10, 2009; Nov 10, 2009 #1 S. sudeepdoon New Member. Hi David, While solving one of the questions i came to a section where I was to calculate the YTM of a zero coupon bond. i had the term and the price of the bond. Thinking that zero coupon bond has just one payment, i ... Zero Coupon Bond Yield - Formula (with Calculator) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

Ytm zero coupon bond. What is a Zero Coupon Bond? Who Should Invest? | Scripbox For example, if the bond's face value is Rs.100, and it pays an interest of 8%. Here, the interest rate is the bond coupon. What is yield to maturity for a zero coupon bond? Yield is a measure of all the cash flows of an investment over a period of time. It considers all the coupon payments and dividends received during the term of an investment. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 ->... Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... (a) Calculate the forward rate of zero-coupon bond with 11% yield to ... Calculate the forward rate of zero-coupon bond with 12% yield to maturity and 3 years maturity Forward rate= (1+YTM for current year) Correspondingy year (1+YTM for current year) Correspondingy year-1 = (1+0.12) 3 (1+0.12) 2-1 = 1.40 1.23-1 =14.03%. Thus, the forward rates obtained for 2 n d year is 12.01% and for 3 r d year is 14.035 Solved What is the YTM of a twenty-year zero coupon bond | Chegg.com What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.75% 5.54% 5.68% 5.85%. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

Solved What is the YTM of a twenty-year zero coupon bond | Chegg.com Expert Answer 5.54% Face value of bond is $ 1000 which is paid at the end of maturit … View the full answer Transcribed image text: What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.85% 5.75% 5.54% 5.68% Previous question Next question Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero Coupon Bond Yield Calculator - YTM of a discount bond A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

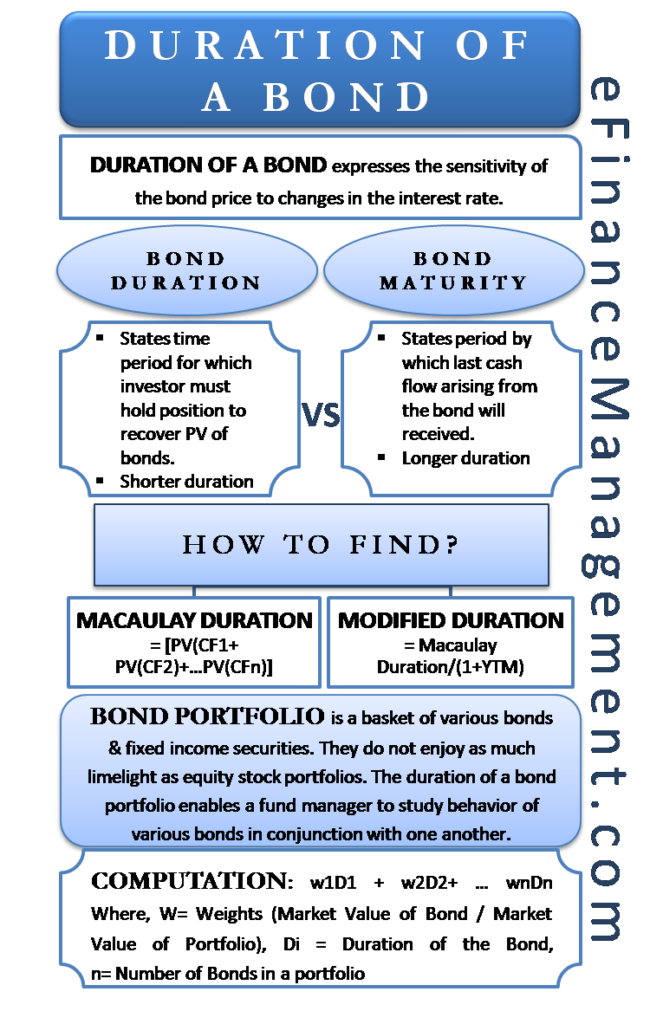

Yield to maturity calculator YTM Y T M is the corresponding return that will equate the present value of all cash flows associated to a bond (coupon payments as well as the face value of the bond that is paid at maturity). Usually, unless we have a zero-coupon bond, the. YTM Y T M cannot computed directly and needs to be solved using Excel, or another ....

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr ... - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

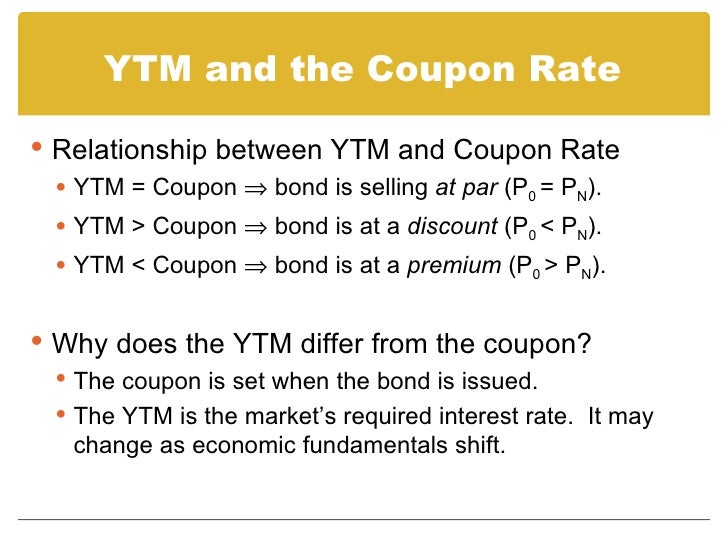

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Yield to Maturity (YTM) Definition - Investopedia Because YTM is the interest ratean investor would earn by reinvesting every coupon payment from the bond at a constant interest rate until the bond's maturity date, the present value of all the...

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Solved What is the YTM of a twenty-year zero coupon bond | Chegg.com What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? a) 5.54% b) 5.68% c) 5.75% d) 5.85% Expert Answer Current price of the zero-coupon bond, PV = $34 … View the full answer Previous question Next question

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows:...

Yield to Worst (YTW): Formula and Bond Excel Calculator Coupon Rate: 6%. Annual Coupon: $60. Now, we'll enter our assumptions into the Excel formula from earlier to calculate the yield to maturity (YTM): Yield to Maturity (YTM): "= YIELD (12/31/2021, 12/31/2031, 6%, Bond Quote, 100, 1)". By contrast, the YTC switches the "maturity" to the first call date and "redemption" to the call ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Yield to Maturity (YTM) Definition & Example - InvestingAnswers The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows: Yield to Maturity Calculator

Zero Coupon Bond Yield - Formula (with Calculator) A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

YTM for a zero coupon bond? | Forum | Bionic Turtle YTM for a zero coupon bond? Thread starter sudeepdoon; Start date Nov 10, 2009; Nov 10, 2009 #1 S. sudeepdoon New Member. Hi David, While solving one of the questions i came to a section where I was to calculate the YTM of a zero coupon bond. i had the term and the price of the bond. Thinking that zero coupon bond has just one payment, i ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Post a Comment for "42 ytm zero coupon bond"