38 coupon rate on bonds

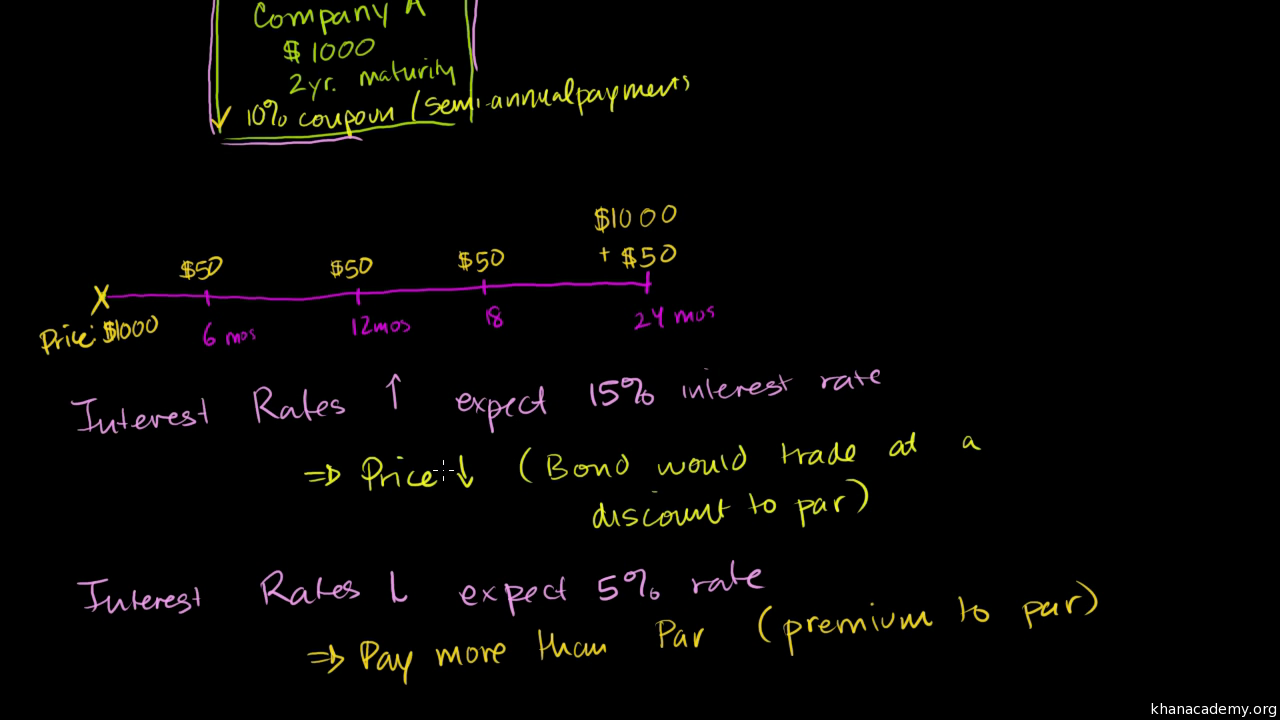

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · Though bonds may be issued with variable rates tied to LIBOR, most bonds are issued with a fixed rate, causing the coupon rate and yield to often be different. 1:21 Comparing Yield To Maturity And ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In secondary markets, bonds may be sold for a premium or discount on their face value. Therefore, although you might've ...

How To Find Coupon Rate Of A Bond On Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year.

Coupon rate on bonds

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ... Solved If a bond's coupon rate is less than its yield to | Chegg.com If a bond's coupon rate is less than its yield to maturity, the bond is selling at: Question: If a bond's coupon rate is less than its yield to maturity, the bond is selling at: This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts.

Coupon rate on bonds. Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Therefore, long-dated zero-coupon bonds respond the most to interest rate changes. When the economy is under pressure, the Federal Reserve usually cuts rates to provide stimulus.

Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. Yield to Maturity (YTM) = 2.83%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. Answered: A coupon-paying bond matures exactly 10… | bartleby Find the bond's coupon rate if a 6-month Forward bond price is equal to $121, the current bond price is $119, and all zero rates for time periods of under 1 year are equal to 7%. Question. A coupon-paying bond matures exactly 10 years and 4 months from now. Find the bond's coupon rate if a 6-month Forward bond price is equal to $121, the ... Bond: Financial Meaning With Examples and How They Are Priced 1.7.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What Is the Coupon Rate of a Bond? - The Balance The coupon rate on a bond or other fixed income security is the stated interest rate based on the face or par value of the bond. The bond's yield is the dollar value of the annual interest payments as a percentage of the bond's current price. Investors can use a bond's coupon rate to benchmark the level of interest they will receive ... How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ...

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it …

Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The coupon rate on a bond issuance can be calculated using the following four-step process: Step 1: First, the face (par) value of the bonds must be found in the financing documents (e.g. bond certificate). Step 2: Next, the number of periodic payments per year expected to be made by the issuer should be found using the same document source as ...

Coupon Rate Calculator | Bond Coupon The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The par value of the bond is $1,000, coupon rate of 6%, and a number of years until maturity in 6 years. Determine the price of the CB if the yield to maturity is 7%. Solution: Given,Par value, P = $1,000; Yield to maturity, YTM = 7%; Since the coupon is paid semi-annually,

Discount Rate Of Bond - Verified Oct 2022 Bond Discount - Investopedia. The bond discount rate is, therefore, $41.31/$1,000 = 4.13%. Bonds trade at a discount to par value for a number of reasons. Bonds on the secondary market with fixed …. Show Coupon Code.

What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Solved If a bond's coupon rate is less than its yield to | Chegg.com If a bond's coupon rate is less than its yield to maturity, the bond is selling at: Question: If a bond's coupon rate is less than its yield to maturity, the bond is selling at: This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts.

Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

Post a Comment for "38 coupon rate on bonds"