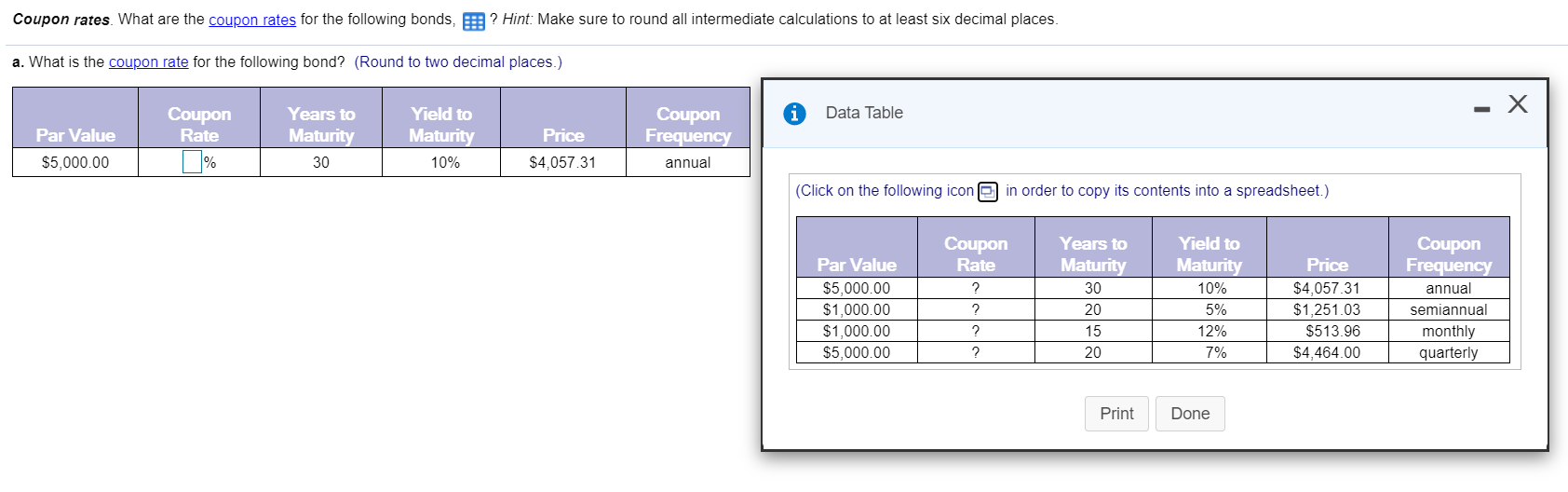

42 what is the coupon rate

Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate | Investor.gov Coupon Rate. The interest rate on a bond. It is expressed as a semi-annual rate.

What is the coupon rate

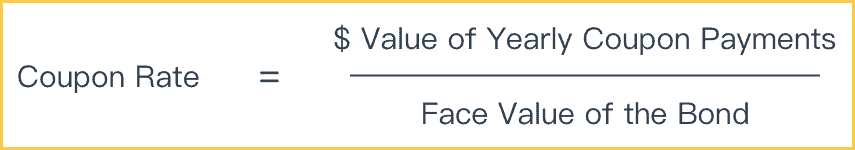

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued.

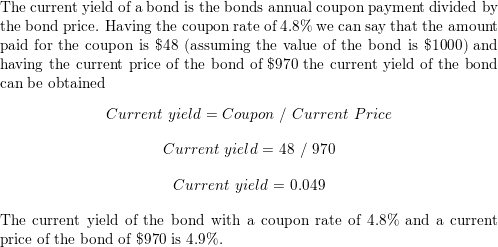

What is the coupon rate. Coupon Rate - What it is, Formula, & Example - Speck & Company A coupon rate is the percentage value of that cash payment relative to the face value of the bond. For example, say we had a bond with a face value of $1,000 and it paid us an annual coupon of $25. The coupon for this bond would be $25/year while the coupon rate would be $25/$1,000 or 2.5%. The coupon rate is the percentage value. Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate. The main difference between Coupon Rate and Interest Rate is that the coupon ... Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the amount of interest the bondholder receives. For most investments, returns vary; however, for bonds, the coupon payments remain the same for the entire tenure of the bond. The coupon payments depend on the face value of the bond and not the market price.

Budget Car Rental Coupons Budget Car Rental Coupons Save up to 10% on low rates. B112100. Up to 25% OFF Base Rates + up to 10% Donated. Save up to 25% on your car rental base rate and up to 10% of your base rate will be donated to Susan G Komen® for breast cancer research. R899700. Weekly Car Rental Deal. Save up to 10% on Rentals of 5 Days or More. D111800 › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. What is the difference between a coupon rate and a yield rate? Coupon rate is the actual amount of interest income earned on the bond each year based on its face value. A bond's yield to maturity (YTM) is the estimated rate of return based on the assumption it is held until maturity date . Investment decisions are taken based on instrument's yield to maturity than its coupon rate. Car Rental Coupons for Discount Rental Cars | Avis Car Rental Save 10% on already LOW RATES at your neighborhood locations K348200 Up to 25% off base rates with 5% donated to Susan G. Komen® A349300 Up to 25% off base rates with 5% donated to Make A Wish® H749900 AARP members save up to 30% off base rates A359807 Up to 25% off base rates for veteran and military family T765700

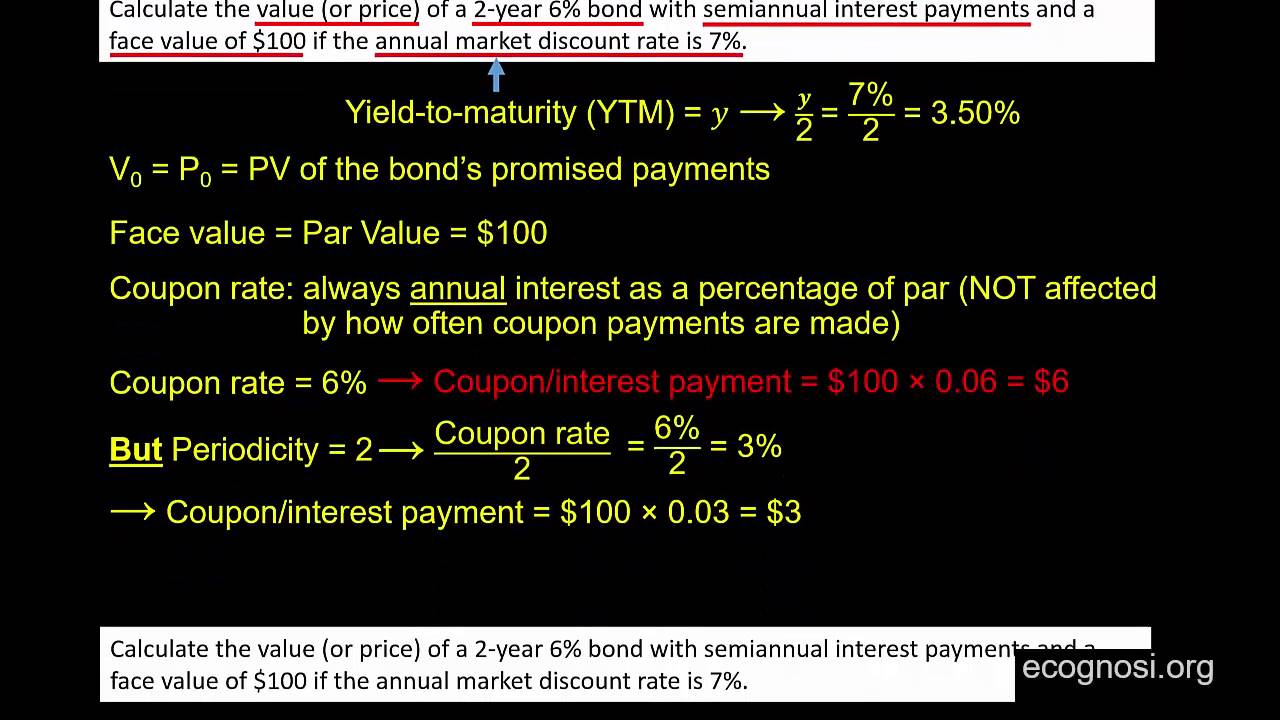

Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. What Is Coupon Rate and How Do You Calculate It? - SmartAsset Coupon rate, also known as the nominal rate, nominal yield or coupon payment, is a percentage that describes how much is paid by a fixed-income security to the owner of that security during the duration of that bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures.

What Is Coupon Rate and How Do You Calculate It? A coupon rate is the yield paid by a fixed-revenue safety; a fixed-income safety's coupon price is simply just the annual coupon funds paid by the issuer relative to the bond's face or par value. The coupon rate, or coupon payment, is the yield the bond paid on its concern date.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued.

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "42 what is the coupon rate"