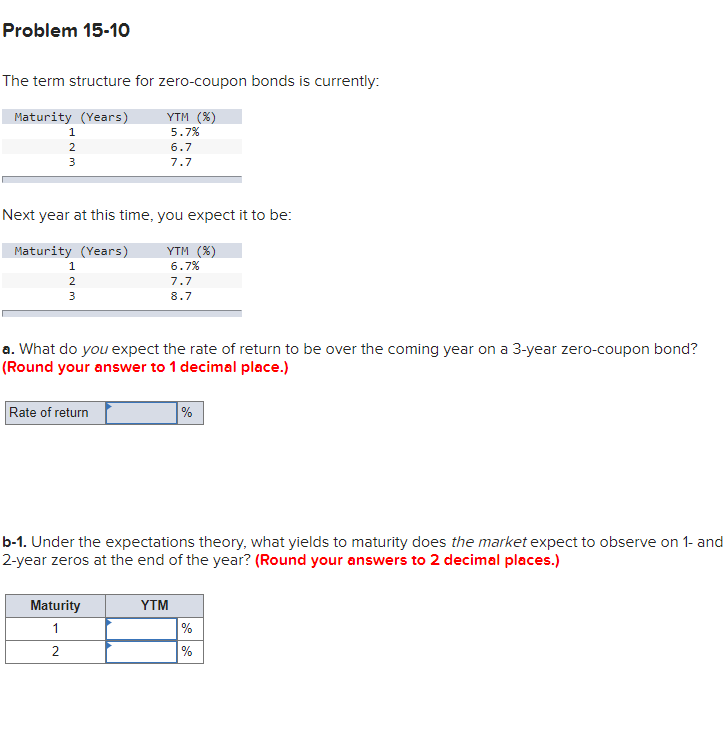

42 what is zero coupon

Find Jobs in Germany: Job Search - Expatica Germany Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language. dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

The Macaulay Duration of a Zero-Coupon Bond in Excel 29.08.2022 · With a zero-coupon bond, the Macaulay duration is its time remaining until maturity. Macaulay duration can be complicated to compute but can be made easier using Excel. Understanding the Macaulay ...

What is zero coupon

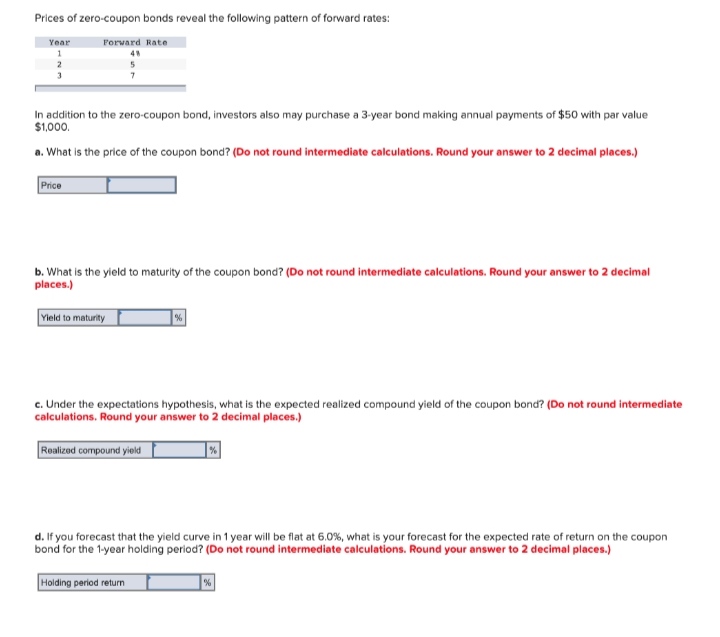

Video News - CNN Watch breaking news videos, viral videos and original video clips on CNN.com. en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included ...

What is zero coupon. it.wikipedia.org › wiki › Obbligazione_zero-couponObbligazione zero-coupon - Wikipedia Un'obbligazione zero-coupon (nota anche come Zero-Coupon Bond, abbreviato ZCB) è un'obbligazione il cui rendimento è calcolato come differenza tra la somma che il sottoscrittore riceve alla scadenza e la somma che versa al momento della sottoscrizione. Il nome deriva dal non pagamento di interessi (cioè niente cedole, inglese: coupon). HOT TOPIC | POP CULTURE AND MUSIC INSPIRED FASHION Music? Check. Pop Culture? Check. Gaming? Check. Hot Topic Has Official Merch For Everyone. Hot Topic Is Where Pop Culture and Music Fandoms Unite. Shop 100% Officially Licensed Merch. Free Light & Fit Zero Sugar Yogurt with new coupon at Harris Teeter 04.11.2022 · Score a free 5.3 oz. Light & Fit Zero Sugar Yogurt from Harris Teeter with the new digital coupon! * This post contains affiliate links and we may earn a small commission if you use them. Score a ... Outlook – free personal email and calendar from Microsoft Get free Outlook email and calendar, plus Office Online apps like Word, Excel and PowerPoint. Sign in to access your Outlook, Hotmail or Live email account.

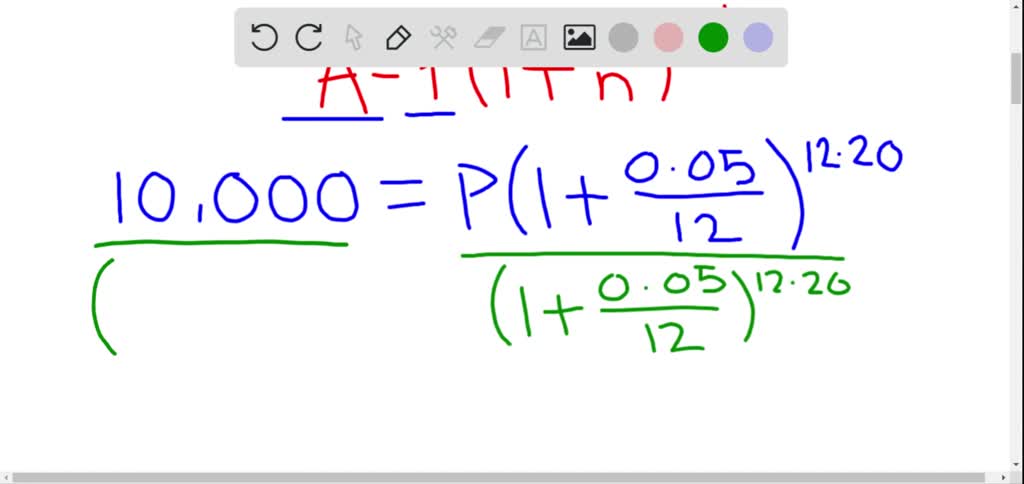

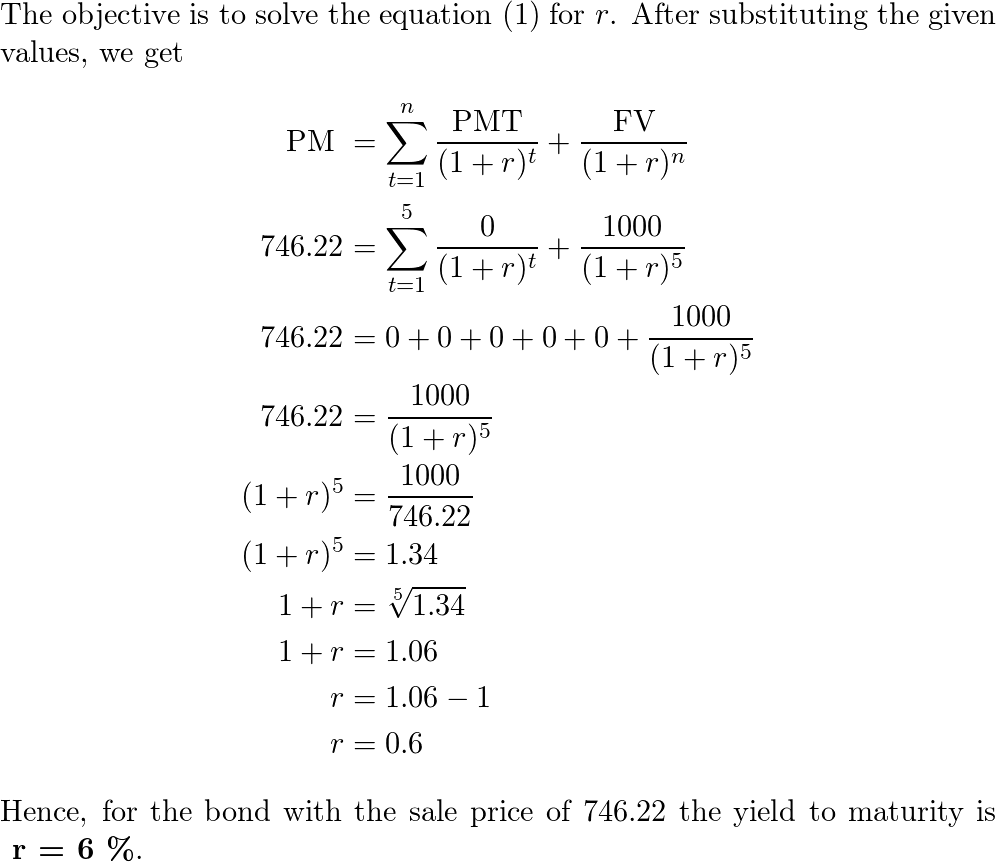

The One-Minute Guide to Zero Coupon Bonds | FINRA.org 20.10.2022 · That said, zero coupon bonds carry various types of risk. Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as ... Complete JAVASCRIPT with HTML5,CSS3 from zero to Expert … Hemanth Kumar has years of experience as a professional instructor and trainer for Data Science and programming. Over the course of his career he has developed a skill set in analyzing data and Design data modeling processes to create algorithms and predictive models and perform custom analysis and he hopes to use his experience in teaching data science and … Zero Coupon Bond Value Calculator: Calculate Price, Yield to … And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. When shorter duration bonds offer a higher yield than longer duration bonds that is called yield curve inversion. If investors are … › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

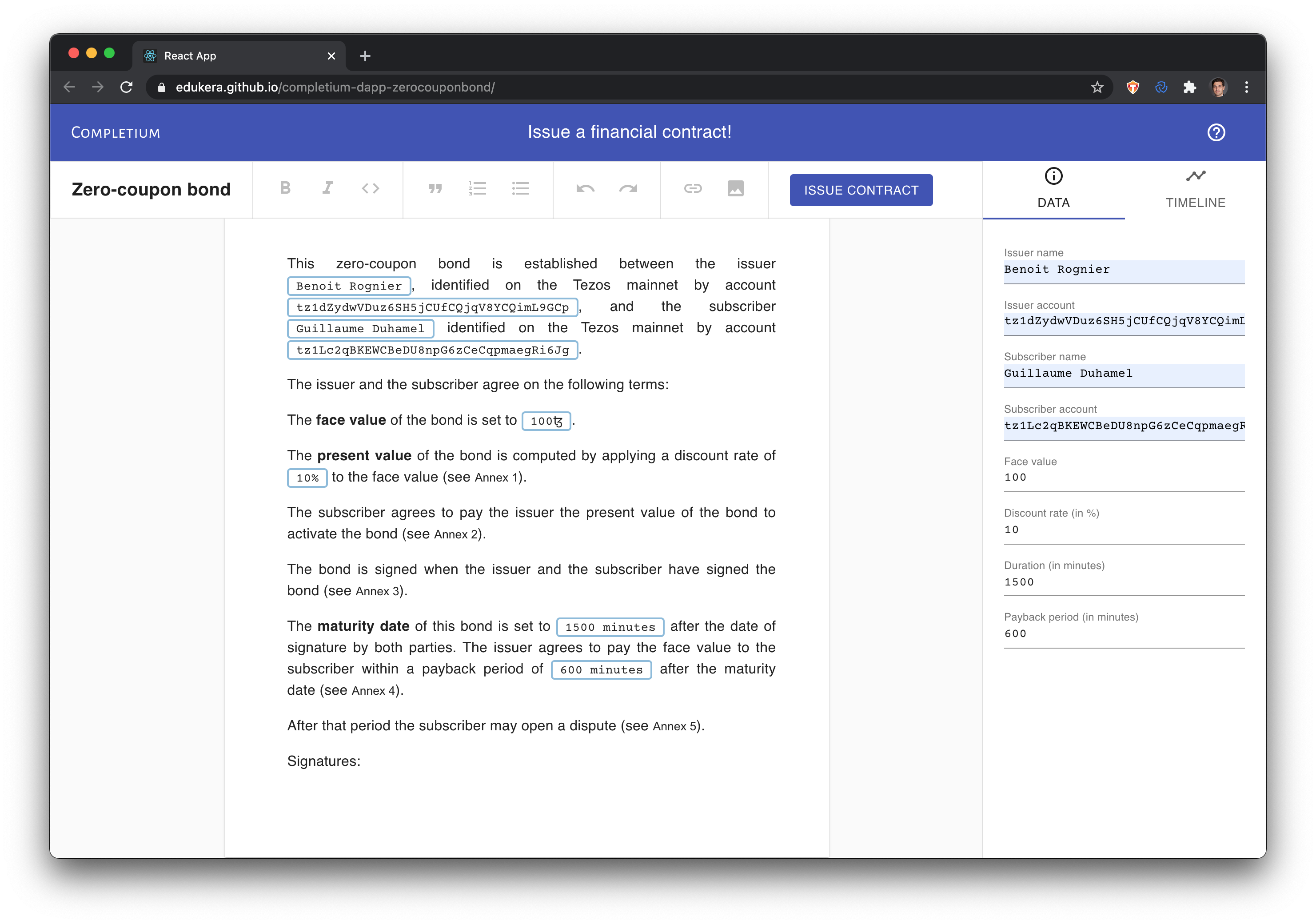

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include … › investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · For example, you might pay $3,500 to purchase a 20-year zero coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. For this reason, zero coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included ...

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

Video News - CNN Watch breaking news videos, viral videos and original video clips on CNN.com.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 what is zero coupon"