38 how to find the coupon rate of a bond

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

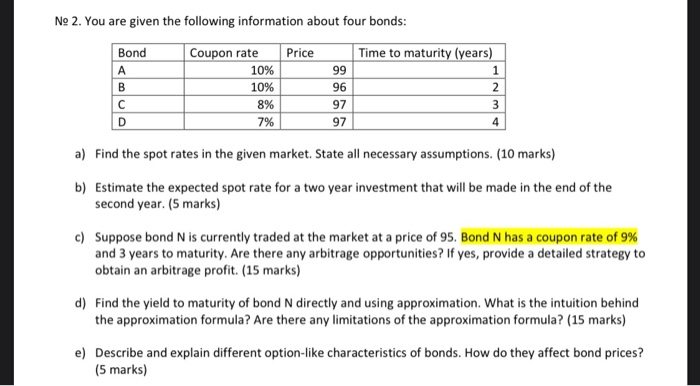

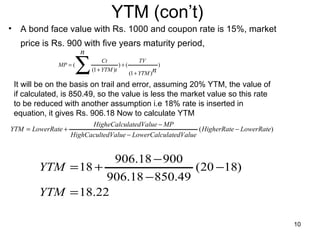

Solved a. Calculate the yield to matunty (YTM) for the bond | Chegg.com a. Calculate the yield to matunty (YTM) for the bond b. What rolationship oxists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain a. The yield to maturity (YTM) for the bond is 16. (Round to two decimal places) Question: a. Calculate the yield to matunty (YTM) for the bond b.

How to find the coupon rate of a bond

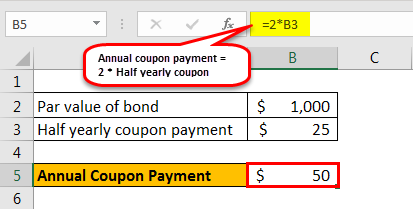

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example,... Chapter 7 Homework.pdf - Chapter 7 Homework A discount bond's coupon ... Which one of the following relationships applies to a par value bond?-Coupon rate = Current yield = Yield to maturity. Which one of the following is the price at which a dealer will sell a bond?-Asked price. MentonCo has 7 percent, semiannual coupon bonds outstanding with a current market price of $1,023.46, ...

How to find the coupon rate of a bond. What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate of a Bond - Harbourfront Technologies Based on these steps, the formula to calculate the coupon rate of a bond is as follows. Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100%. For example, a bond offers a total annual coupon payment of $50. The bond 's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100). Par Bond - Overview, Bond Pricing Formula, Example Example 3: Par Bond. Consider a bond with a 5-year maturity and a coupon rate of 5%. The market interest rate is 5%. For the bond above, the coupon rate is equal to the market interest rate. In such a scenario, a rational investor would only be willing to purchase the bond at par to its face value because its coupon return is the same as the ...

What is the average interest rate on bonds? - KnowledgeBurrow.com To calculate the annual interest, you need to know the coupon rate and the price of the bond. What's the interest rate on a 5 year bond? For example, Company XYZ issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 8 percent, so the bond must be issued at a premium. ... How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Find the bond coupon rate. The coupon rate is usually expressed as a percentage (e.g., 8%). [4] You'll need this information, also provided by your broker, to calculate the coupon payment. 4 Get the current yield, if available. The current yield will show you your return on your bond investment, exclusive of capital gains. [5] How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

A $6,000 bond had a coupon rate of 4.25% with | Chegg.com A $6, 000 bond had a coupon rate of 4.25% with interest paid semi-annually. Brian purchased this bond when there were 7 years left to maturity and when the market interest rate was 4.50% compounded semi-annually. He held the bond for 4 years, then sold it when the market interest rate was 4.00% compounded semi-annually. a. Answered: Calculate the current price of a $1,000… | bartleby Transcribed Image Text: Calculate the current price of a $1,000 par value bond that has a coupon rate of 6 percent, pays coupon interest annually, has 29 years remaining to maturity, and has a current yield to maturity (discount rate) of 10 percent. (Round your answer to 2 decimal places and record without dollar sign or commas). SOLVED: Earl Washington wishes to find the YTM on Mills Company's bond ... Consider a coupon bond that has a $\$ 1,000$ par value and a coupon rate of $10 \%$. The bond is currently selling for $\$ 1,044.89$ and has two years to maturity. What is the bond's yield to maturity? The Economics of Money, Banking, and Financial Markets . Chapter 4. Understanding Interest Rates. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Firstly, determine the par value of the bond issuance, and it is denoted by P. Next, determine the periodic coupon payment based on the coupon rate of the bond based, the frequency of the coupon payment, and the par value of the bond. The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment

Coupon Bond Formula | Examples with Excel Template - EDUCBA The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. As per the current market trend, the bonds with similar risk profile have yielded to maturity of 6%. Calculate the market price of the bonds based on the given information.

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value...

Calculate the Coupon Rate of a Bond - YouTube 33,837 views Jul 25, 2018 This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond...

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Answered: You want to find the value of a… | bartleby Transcribed Image Text: You want to find the value of a corporate bond with an annual coupon rate of 3%, making semi-annual coupon payments for 5 years, after which the bond matures, and the principal must be repaid. Assume a current YTM of 4%. (round to the nearest cent) {DO INCLUDE COMMAS OR $} Type your response Submit

Colombia Girds for Bond Coupon Shock to Cut Refinancing Risk The country raised $2 billion by selling 2032 bonds in April 2021, which were priced to yield 3.356%. Demand totaled $4.2 billion, or 2.6 times the amount offered, the ministry said. Fitch Ratings ...

Chapter 7 Homework.pdf - Chapter 7 Homework A discount bond's coupon ... Which one of the following relationships applies to a par value bond?-Coupon rate = Current yield = Yield to maturity. Which one of the following is the price at which a dealer will sell a bond?-Asked price. MentonCo has 7 percent, semiannual coupon bonds outstanding with a current market price of $1,023.46, ...

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example,...

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

![Solved Problem 6-33 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/f0d/f0d3e3cc-89c9-4eed-b5c1-9f247c01695c/php2LGFUe.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

![Solved Problem 6-33 Coupon Rates [LO 2] You find the | Chegg.com](https://d2vlcm61l7u1fs.cloudfront.net/media%2Ff03%2Ff03d6014-74fb-4eaa-925c-f616ab6ad67e%2FphpfU7HCp.png)

Post a Comment for "38 how to find the coupon rate of a bond"