45 coupon rate and ytm

Understanding the Yield to Maturity (YTM) Formula | SoFi The YTM is stated as an annual rate and can differ from the stated coupon rate. The calculations in the yield to maturity formula include the following factors: • Coupon rate: Also known as a bond's interest rate, the coupon rate is the regular payment issuers pay bondholders for the right to borrow their money. The higher the coupon rate ... Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

Yield to Maturity (YTM) Calculator Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturity.

Coupon rate and ytm

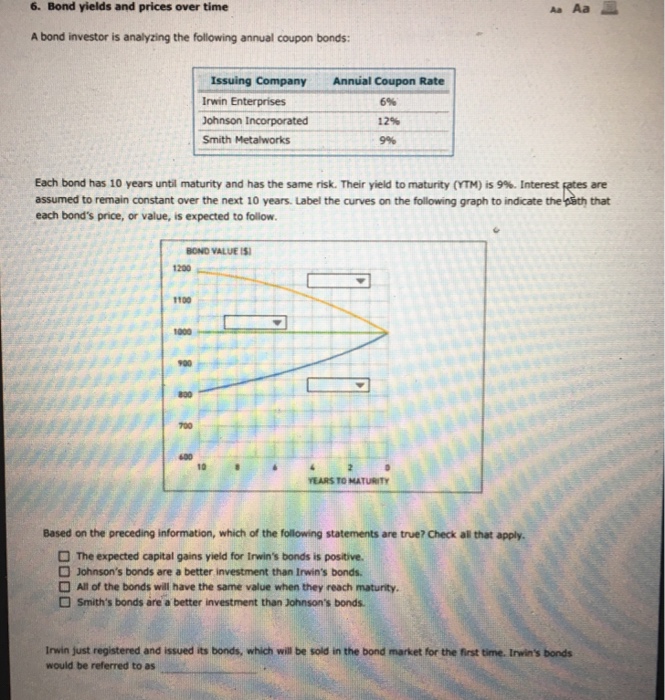

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate › knowledge-center › what-is-theWhat Is the Difference Between IRR and the Yield to Maturity? Mar 27, 2019 · Yield to maturity The biggest difference between IRR and yield to maturity is that the latter is talking ... The bond's face value is $1,000 and its coupon rate is 6%, so we get a $60 annual ... Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

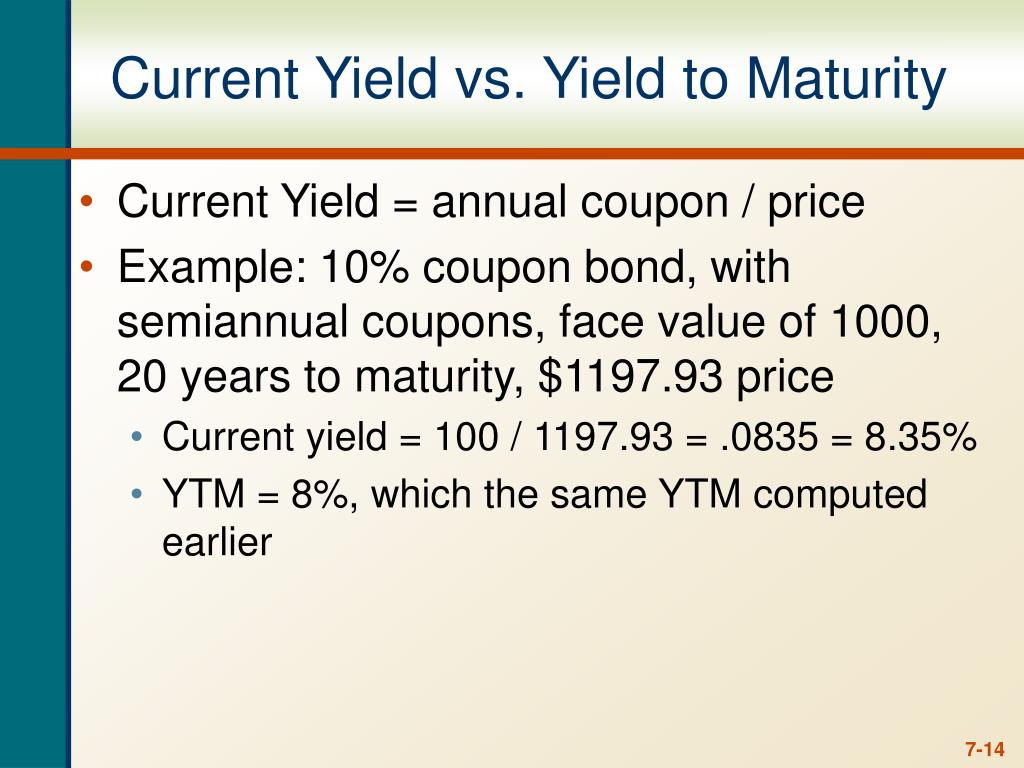

Coupon rate and ytm. Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3 Coupon vs Yield | Top 8 Useful Differences (with Infographics) 7. The Coupons are fixed; no matter what price the bond trades for. Yield and prices are inversely related. 8. An investor purchases a bond at its par value; the yield to maturity is equal to the coupon rate. An investor purchases the bond at a discount; its yield to maturity is always higher than its coupon rate.

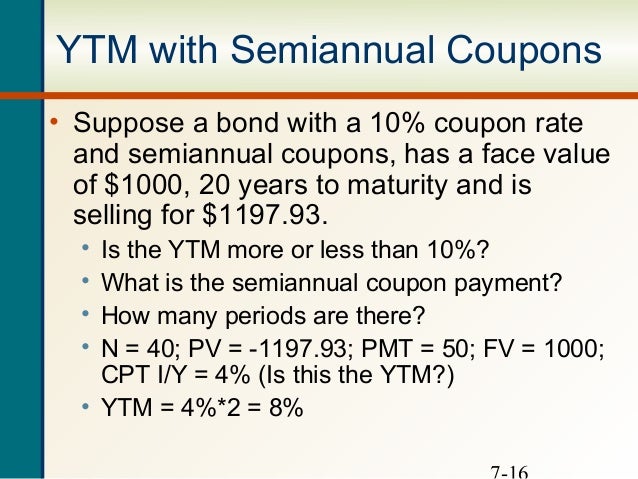

Difference between YTM and Coupon Rates A YTM, or yield-to-maturity, reflects the annual return an investor would receive if they held a bond until it matures. A coupon rate is the percentage of the face value of a bond that is paid out as interest to investors on a yearly basis. The higher the coupon rate, the more money investors will earn on their investment. Yield to Maturity (YTM): Formula and Excel Calculator An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. Yield to Maturity Calculator | YTM | InvestingAnswers How to Calculate Yield to Maturity. For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and matures in 5 years. You would enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to maturity "2" as the coupon payments per year, and "900" as the current bond ... Answered: Find the yield to maturity on a… | bartleby Find the yield to maturity on a semi-annual coupon bond with a face value of P 1,000, a coupon rate of 10%, and 20 years remaining until maturity given that the bond price is P 870. ... Laurel, Inc., has debt outstanding with a coupon rate of 5.8%and a yield to maturity of 7.1%.Its ...

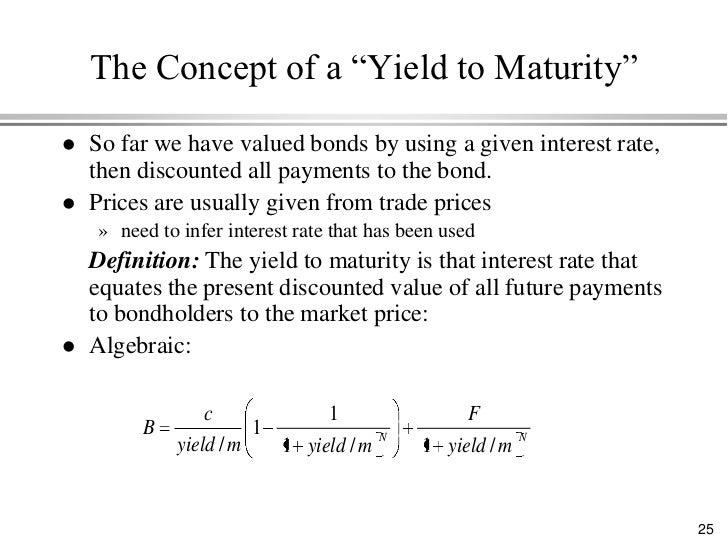

Bond Yield to Maturity (YTM) Calculator - DQYDJ We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. The summation looks like this: Price = Coupon Payment / ( 1 + rate) ^ 1 + Coupon Payment / ( 1 + rate) ^ 2 ... + Final Coupon Payment + Face Value / ( 1 + rate) ^ n Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Yield to Maturity (YTM) Definition - Investopedia The main difference between the YTM of a bond and its coupon rate is that the coupon rate is fixed whereas the YTM fluctuates over time. The coupon rate is contractually fixed, whereas the YTM... What is a Coupon Rate? | Bond Investing | Investment U Coupon Rate vs. Yield to Maturity One of the most important metrics to use a bond's coupon rate is Yield to Maturity (YTM). Because the coupon remains fixed, investors can use it to calculate the total yield of a bond if held to maturity, assuming all interest payments.

Yield to Maturity (YTM) - Meaning, Formula and Examples The coupon rate is more or less fixed. How do YTMs work? The price at which the bond can be bought from the market will tell you the present value of all the cash flows in the future. But, bonds are marketable securities, and the prices fluctuate with moving interest rates in the economy. Now, here's the catch.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

Yield to Maturity Calculator | Calculate YTM The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the principal; r - YTM ...

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ...Face value: 10%

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Yield to Maturity (YTM) - Definition, Formula, Calculations The coupon rate is 7.5% on the bond. Based on this information, you are required to calculate the approximate yield to maturity on the bond. Solution: Use the below-given data for calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually.

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Yield to Maturity | Formula, Examples, Conclusion, Calculator What is the yield to maturity rate? The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

Difference Between Coupon Rate and Yield to Maturity (With Table) The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

› knowledge-center › what-is-theWhat Is the Difference Between IRR and the Yield to Maturity? Mar 27, 2019 · Yield to maturity The biggest difference between IRR and yield to maturity is that the latter is talking ... The bond's face value is $1,000 and its coupon rate is 6%, so we get a $60 annual ...

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate

![[탑텐몰] 3주년 당신에게 몰입합니다!](https://imgp.topten10mall.com/ost/news/ttm/210217/pc/img/step-2-coupon-10-percent.png)

Post a Comment for "45 coupon rate and ytm"